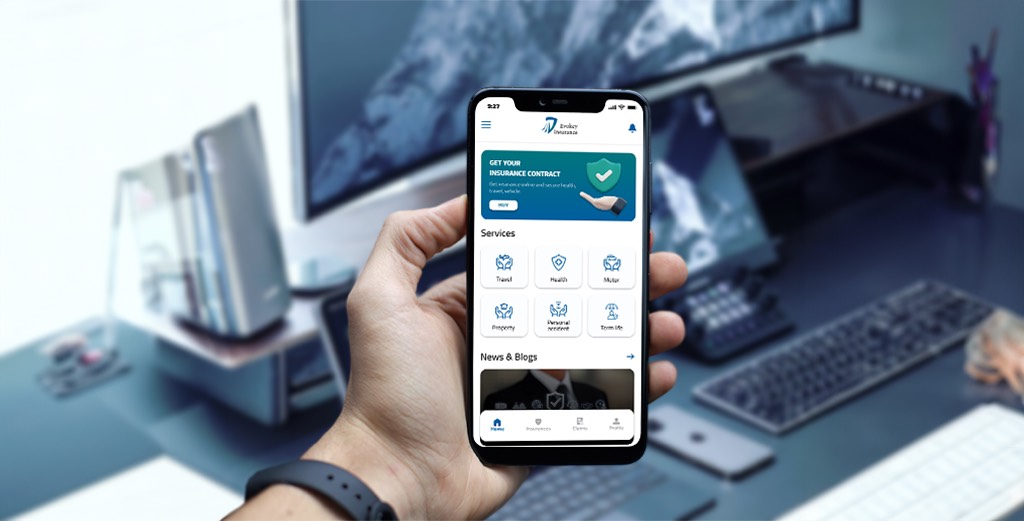

In this modern day and age, Mobile Applications are crucial for business development. In this era almost everything is within the reach of the tip of the finger due to the digital modernization the world has undergone. Let us discuss how digital transformation can transform your insurance business for the better, and what exactly are the benefits of digital applications for insurance companies.

Mobile apps offer several benefits for insurance companies, as well as for policyholders:

- Convenience: Mobile apps allow policyholders to manage their insurance policies conveniently from anywhere at any time. They can pay premiums, file claims, and access policy documents instantly without the need to visit a physical office or make phone calls.

- Accessibility: With mobile apps, insurance services are accessible to a wider range of people, including those in remote areas or with mobility issues. This accessibility can lead to increased customer satisfaction and retention.

- Real-time Assistance: Mobile apps can provide real-time assistance through features like chatbots or instant messaging. Policyholders can get quick answers to their questions, guidance on policy terms, or assistance with claims processing.

- Personalization: Insurance companies can use mobile apps to offer personalized services based on individual policyholder needs and preferences. This can include tailored policy recommendations, discounts, or notifications about relevant policy updates.

- Enhanced Communication: Mobile apps facilitate seamless communication between insurance companies and policyholders. Companies can send important updates, alerts about upcoming payments, or reminders for policy renewals directly to the user’s mobile device.

- Claims Processing: Mobile apps streamline the claims process by allowing policyholders to submit claims directly through the app. They can upload photos or documents, track the status of their claim, and receive updates on the resolution, all from their mobile device.

- Data Collection and Analysis: Mobile apps generate valuable data for insurance companies, which can be used for risk assessment, pricing strategies, and improving overall customer experience. Analyzing user behavior within the app can provide insights into customer preferences and needs.

Cost Reduction: By promoting self-service options and reducing the need for manual processes, mobile apps can help insurance companies save on operational costs. This can lead to lower premiums for policyholders or increased profitability for the insurer

Insurtech, short for insurance technology, refers to the innovative use of technology to improve and modernize the insurance industry. Insurtech companies leverage advancements in artificial intelligence, machine learning, data analytics, blockchain, and other technologies to offer new products, streamline processes, enhance customer experiences, and disrupt traditional insurance practices

How Insurtech is shaping the insurance landscape:

- Digital Distribution Channels: Insurtech companies often utilize digital platforms and mobile apps to provide insurance products directly to consumers, bypassing traditional intermediaries like agents or brokers. This approach offers convenience and accessibility while reducing distribution costs.

- Data Analytics and Risk Assessment: Insurtech startups harness big data and advanced analytics to assess risks more accurately. By analyzing vast amounts of data from various sources, including social media, IoT devices, and historical claims data, they can develop more personalized underwriting models and pricing strategies.

- Peer-to-Peer Insurance: Some Insurtech companies have introduced peer-to-peer (P2P) insurance models, where groups of individuals pool their premiums to cover each other’s losses. Blockchain technology is often used to facilitate transparent and secure transactions within these P2P networks.

- On-Demand Insurance: Insurtech startups are pioneering on-demand insurance solutions that allow consumers to purchase coverage for specific events or time periods, such as travel insurance for a single trip or rental insurance for a day. These flexible, pay-as-you-go policies cater to changing consumer preferences and lifestyles.

- Customer Experience Enhancement: Insurtech companies prioritize customer-centricity by offering intuitive digital interfaces, personalized recommendations, and responsive customer support through various channels, including chatbots and mobile apps. This focus on improving the customer experience helps attract and retain policyholders.

- Regulatory Compliance Solutions: Compliance with regulatory requirements is a key concern for insurers. Insurtech firms develop regulatory technology (RegTech) solutions to help insurance companies navigate complex regulatory frameworks more efficiently, ensuring compliance while reducing administrative burdens.

In conclusion, Insurance companies are in crucial need to have accessible mobile apps for their clients. The benefits are numerous and they fit in the modern world’s needs.